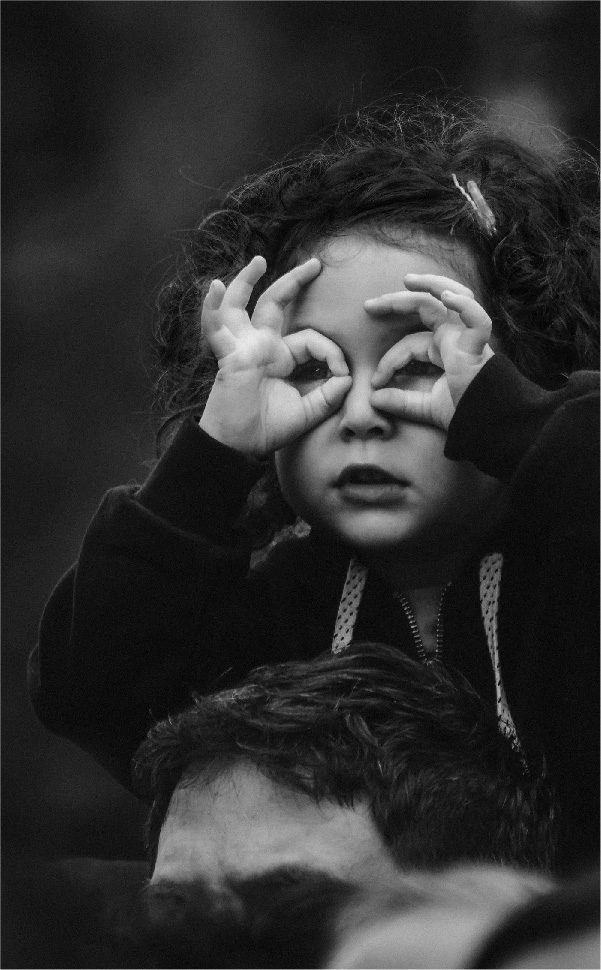

Deciphering your child’s interests and aptitude.

We are now part of the Fourth Industrial Revolution. A revolution, given the backdrop of the climate change, in which disruptive technologies and trends such as the Internet of Things (IoT), robotics, virtual reality (VR) and artificial intelligence (AI) are changing the way we live and work.

As parents, the fact that the world is changing is less profound and more worrying. The discomfort stemming from the fact that traditional jobs in so called stable sectors are not just under threat but at the risk of oblivion.

Education Inflation is much higher.

Of all the cost heads, education has been more prone to the ravages of inflation. A recent report* notes that over the last decade, while consumer price inflation (CPI) has been around 6%, the rate of inflation in education has been significantly higher, at around 11-12 per cent implying that education costs could double every six to seven years.

Right from pre-school fees which could be between Rs 50 thousand to Rs 1 lakh, schools which charge between 2-5 lakhs per annum to under-graduate courses abroad which set you back by a minimum of Rs 40 lakhs, per annum investment in education is neither trivial nor static.

*Source: BankBazaar

Deciding where to invest

YOUR INVESTMENT OPTION MUST BEAT INFLATION. The thumb rule when it comes to investing is the following – For longer term goals with a time horizon of more than 5 years one must embrace volatility and aim to beat inflation.

Traditional saving methods are useful for shorter term goals, and may not be advisable for longer term goals like education.

Thus, investing in instruments that have the potential to beat inflation in the long run, such as equity mutual funds schemes (through systematic investment plans), can help parents meet such investment goals.

Do we need a dedicated Children’s Fund?

Wouldn’t any open-ended equity fund suffice?

Having a longer time horizon is as much a positive and a negative. The positive is that you don’t have to incur unnecessary risks as time is your ally. The negative is that when your goal is some time away there is a tendency to use up the money the moment you see it appreciating or redeem prematurely the moment you witness market volatility. This is where discipline and structure of the fund comes in handy.

A fund structure with a compulsory lock-in period reins in the temptation to react each time the market changes course or when you need money. A children’s fund is an open-ended fund with a compulsory lock-in of 5 years or till the child attains age of majority (whichever is earlier). This ensures that you are forcibly disciplined.

This lock-in is also useful to the fund manager for they too can commit to longer tenures without having to worry about providing for short term liquidity.

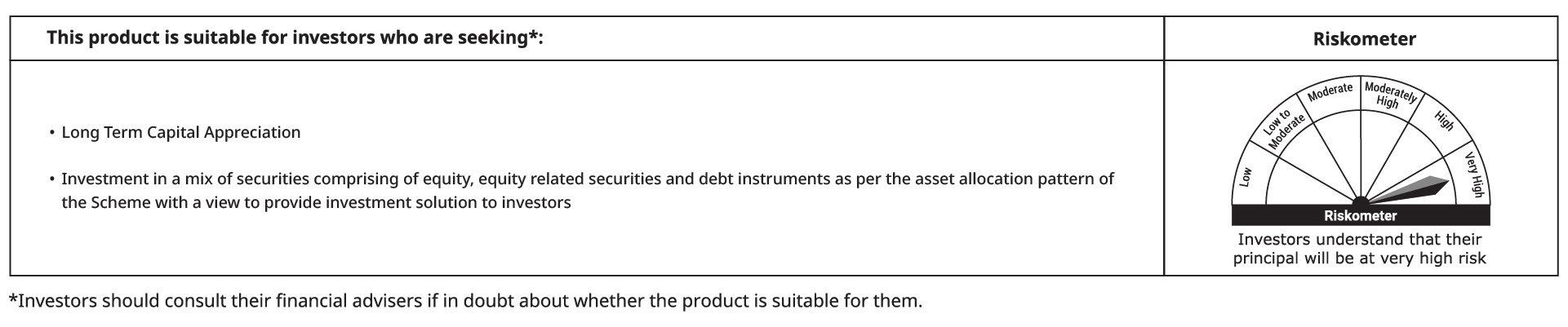

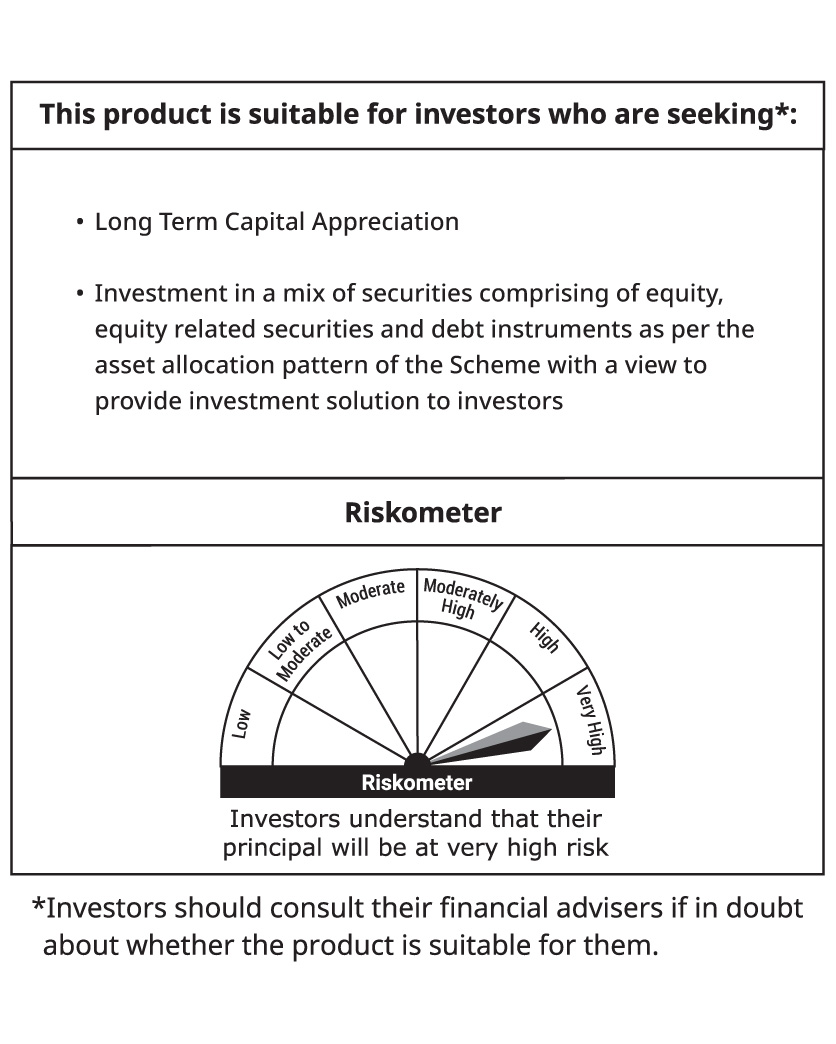

Product Label

Note: The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

New Fund Offer (NFO) opens on

November 28, 2023

NFO closes on

December 12, 2023

Scheme re-opens

Within 5 Business Days from Allotment.